If you’re new to investing, some of the information on the Internet can be downright confusing. While investing itself is relatively straightforward, many

Veterans in Texas should check out if they qualify for the Hazlewood Act exemption for public higher education. If so, they should take advantage of this unique

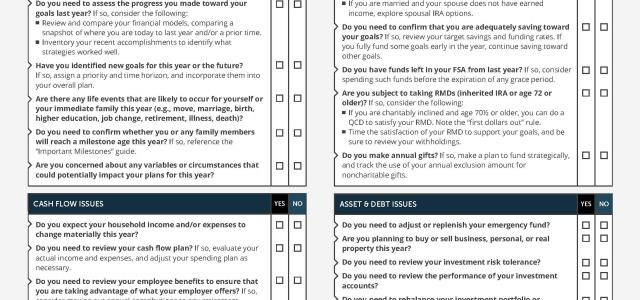

The beginning of a new year is the perfect time to think about the various factors influencing your finances and planning.

For example, you can:

- Take a look

With 529 education savings plans offered by most states, how do you take advantage of the income tax benefits of these plans? If you are fortunate enough to be

Professors, administrators, and staff in public higher education institutions in Texas have many different options for retirement plans.

Professors and

As a retirement plan, 401(k) plans currently outpace the competition, with more than 54 million Americans participating in a 401(k) plan and nearly 550,000

Key Takeaways:

Pros of TSP Rollover: Full control of investments, more investment options, portability, professional money management

Cons of TSP Rollover: Ty

Increasingly tech start-up companies are moving to Texas to take advantage of lower taxes and a more favorable business climate. With these moves, high-tech

An increasing number of studies look at the Return on Investment or ROI of a college education. The ROI is essentially the cost of attendance divided by what