Having a pension is becoming increasingly rare, especially in the private sector. Many private pensions have been frozen, and employees can no longer contribute

What the Rule of 80 Is and Why It Matters

If you're a Texas public school educator, your retirement benefits are managed by the Teacher Retirement System of

When it comes to saving for your children's future, choosing the right account can make a huge difference. Each type of account has different rules about taxes

As a professor with nearly 25 years in higher education, I understand firsthand the unique challenges educators and public service professionals face when it

As a financial planner, I frequently hear this question: "Should I use a target-date fund or build my own portfolio?"

The answer isn't about which approach

Bear markets are inevitable, but permanent loss is not. The mix between stocks and bonds in your portfolio largely determines how far you fall during a downturn

When you inherit an IRA from someone other than your spouse, you face decisions that can shape your tax bill for a decade or more. The SECURE Act and subsequent

A research-based guide to one of retirement planning's biggest decisions

As an educator-turned-financial-planner, I frequently field questions from teachers

How the One Big Beautiful Bill Act creates new opportunities to avoid hidden tax traps in retirement

As a financial planner who has spent years helping educators

The One Big Beautiful Bill Act (OBBBA), signed into law in July 2025, extends and modifies many provisions of the 2017 Tax Cuts and Jobs Act (TCJA). While the

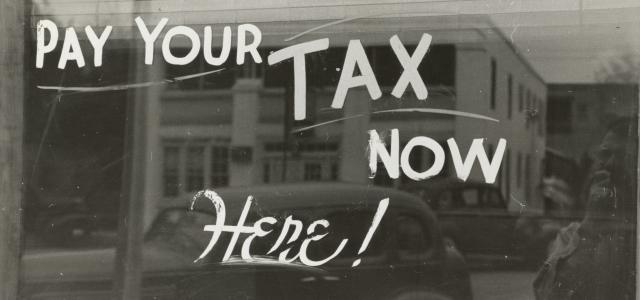

What Exactly Is a Pension?

A pension is a retirement plan where your employer guarantees specific monthly payments for life. Unlike a 401(k), where you bear