Becoming an empty nester is a big life change. After years of focusing on raising children, your house—and your finances—suddenly feel different. While this can

Transitioning between careers—whether moving from public service to the private sector, pursuing further education, or entering retirement—can be financially

Key Takeaways:

1) Save at least 20% of your gross income for retirement.

2) Create a budget using the 50/30/20 Rule.

3) Maximize your employee benefits.

4)

The number of teachers that leave the profession has grown alarmingly in Texas. In addition, the average teacher's salary in Texas is well below other larger

Working in university healthcare can be an enriching career opportunity for a doctor or healthcare professional. The opportunities to serve traditionally, more

Are you a Do-It-Yourself (DIY)-er type of person? Maybe you are the one who sees something that needs to get done or fixed around your home or office and takes

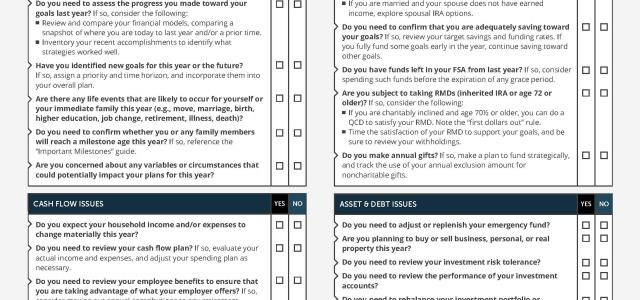

The beginning of a new year is the perfect time to think about the various factors influencing your finances and planning.

For example, you can:

- Take a look

Goal-Based Financial Planning

Goal-based financial planning has become extremely popular in personal finance circles. This is where you prioritize your

The employee benefits for professionals in corporate careers can be generous. Increasingly, most large corporate employers' focus is to provide some level of

Jim Collins' blockbuster bestseller book, Good to Great, exemplifies going from getting Good results to getting Great results. Although his ideas have been

A 2020 Vanguard survey of generations and investing showed that younger Americans (Gen Z and Millennials) are significantly around three quarters more

Health care employees, such as nurses, work in a unique environment, with long work shifts and heavy demands on their schedules. In this blog, we discuss five k