Trump Accounts: Should You Open One for Your Newborn?

If you're expecting a baby or have a child born between 2025 and 2028, you've likely heard about the new Trump Accounts. Under this new program, the government offers $1,000 in free starter money for each eligible newborn American baby. But is it really a smart financial move? Note: Program details should be verified with official IRS guidance, as specific rules may be subject to regulatory clarification.

The key question: Should you use Trump Accounts as part of your savings strategy, or are other accounts more suitable? The answer depends on your goals and financial situation.

What Makes Trump Accounts Special

The One Big Beautiful Bill Act (OBBBA), signed into law by President Donald Trump on July 4, 2025, created the Trump Accounts program. Here's how it works:

- $1,000 Government Seed Money: Every eligible newborn gets $1,000 invested automatically—free money to kickstart their financial future.

- Eligibility Window: Children born between January 1, 2025, and December 31, 2028, are eligible for the $1,000 seed money. Children born before 2025 can still open accounts but don't receive the government contribution.

- Annual Contributions: Parents or guardians can contribute up to $5,000 per year, every year, until the child turns 18.

- Employer Contributions: Employers can contribute up to $2,500 per year (adjusted for inflation) to a Trump Account for their employees or dependents. These contributions are excluded from the employee's gross income and don't count toward the $5,000 annual limit.

- Tax-Deferred Growth: Earnings inside the account grow tax-deferred, meaning you don't pay taxes annually on gains.

- Investment Structure: Funds must be invested in diversified funds that track a U.S. stock index (such as S&P 500 or other U.S. equity indexes). The funds must be unleveraged and have annual fees no higher than 0.1%.

- Eligibility Rules: The child must be a U.S. citizen, and the parent (or filing parent) must have a valid Social Security number.

Important Rules You Should Know

Before getting too excited, understand the rules:

- Withdrawals before age 18: No withdrawals are permitted from a Trump Account before the beneficiary turns 18. This is a complete prohibition, not a penalty situation.

- After age 18: Once the beneficiary turns 18, the Trump Account operates like a traditional IRA. Early withdrawals (before age 59½) are subject to ordinary income tax and a 10% penalty, unless an exception applies (such as first-time home purchase, qualified educational expenses, disability, or certain medical expenses).

- Account Duration: After age 18, they function as traditional IRAs and are subject to standard IRA rules, including Required Minimum Distributions (RMDs) starting at age 75.

- Tax Treatment: Qualified withdrawals are taxed as ordinary income, unlike 529 Plans where qualified withdrawals can be tax-free.

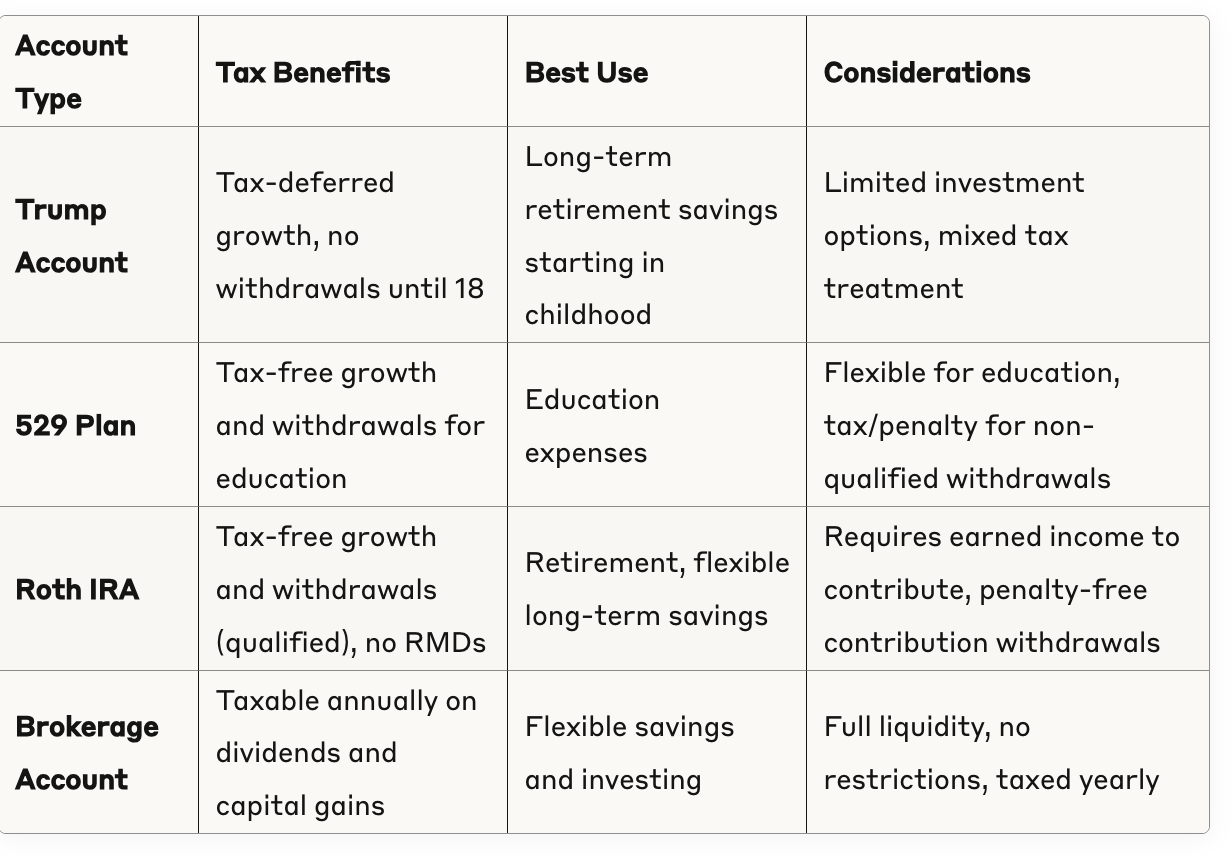

Comparing Trump Accounts to Other Savings Options

Smart Strategy: How to Use Trump Accounts Wisely

1. Take the Free $1,000

This is a no-brainer. Even with restrictions, free starter money with 18+ years of investment growth potential is worth claiming.

2. Understand the Rules

These are long-term accounts meant to grow tax-deferred, with restrictions similar to IRA retirement accounts. Be mindful of taxes and penalties on withdrawals.

3. Prioritize Financial Basics First

Max out your retirement accounts, build an emergency fund, and fund a 529 plan for education before contributing extra to a Trump Account.

4. Use as a Supplement, Not a Primary Savings Vehicle

Think of this account as supplemental—a helpful boost, not a replacement for core financial planning.

Who Benefits the Most?

- High Earners: Great for those already maxing out retirement and education savings, offering additional tax-deferred growth space.

- Middle-Income Families: Claim the $1,000 seed money, but focus on core financial needs before adding extra.

- Legacy Builders: With up to $90,000 in potential lifetime contributions ($5,000/year for 18 years), these accounts can help transfer generational wealth—but the taxable nature of withdrawals should be considered.

- Employees with Generous Employers: Take advantage of employer contributions up to $2,500 annually if your employer offers this benefit.

Your Action Plan

✅ Verify Eligibility: U.S. citizen child, valid parental Social Security number.

✅ Claim the Free $1,000: Don't leave free money on the table (only for children born 2025-2028).

✅ Incorporate Wisely: Use alongside, not instead of, proven strategies like 529 plans and retirement accounts.

✅ Check Employer Benefits: Ask if your employer offers Trump Account contributions as part of their benefits package.

✅ Plan for Long-Term Growth: Expect the account to function as a traditional IRA after age 18, with standard IRA withdrawal rules and RMDs.

✅ Get Professional Guidance: A financial advisor can help you optimize contributions and withdrawals.

Final Thoughts

Trump Accounts provide a unique opportunity to kickstart your child's savings with free government money and tax-deferred growth. Just be aware of the limitations.

✅ Claim the free $1,000 (if eligible).

✅ Use it strategically with your broader financial plan.

✅ Don't sacrifice flexibility or better tax treatment elsewhere.

Want to build a smart financial plan for your family's future? Schedule a free consultation today and we'll help you create a personalized strategy—with or without Trump Accounts—to achieve your family's financial goals.

*We believe the information provided is accurate, but it's not intended as tax or legal advice and shouldn't be used to avoid federal tax penalties. For guidance on your specific situation, please consult your own tax or legal advisor. If you're doing estate planning, it's important to work with professionals, including your attorney or tax expert. This content does not include specific investment advice or recommendations to buy or sell any securities. Also, while strategies like asset allocation and diversification can help manage risk, they do not guarantee profits or protect against losses in a declining market.